Bangalore Blog 4 - All about buying a house. Part 1 - Renting vs Buying

Back when I was on Kotak Wealth Management as a “private banker”, we were not licensed to provide advisory on pure-play real estate or sell flats/land etc. Nonetheless, as financial advisors, some clients and prospects quizzed us on whether XYZ real estate was a good choice to buy.

The residential real estate market has been on a tear in the last 2 years - however things were quite different back in 2016-2018 and the years preceding that. Even in a fast growing city like Bangalore, there was an over supply of new houses but not enough buyers and hence buying a flat or a standalone house for investment purposes was not the best idea unless you got a killer deal. And killer deals were likely to come by mainly for people who were already deeply entrenched in this field.

In fact it was commercial real estate, which is going through a slightly rough patch now, that was ruling the roost back then with eye popping rental yields such as 8-9% and was attracting a lot of investment from domestic and international investors back then.

Also, the maths behind buying say a flat just didn’t add up back then.

To give you a simple illustration, suppose you buy a flat for 1 Cr and rent it out for around 30k a month. That would give you 3.6L or 3.6% rental yield per year on your investment of 1 Cr. In order to beat a 7% FD, you needed your flat to also appreciate in value by at least 3.5% per year and if you wanted to beat returns on equity (long term), the appreciation would need to be at least 8%. I am not even factoring in other costs such as -

Property tax

Internal repair and maintenance of the flat (say getting a new geyser, repair some wall etc)

Loss of possible income if you didn’t have it rented out for some reason

EMI of the flat (assuming it had some mortage) that was far higher than the rent that you were getting as income

So when I was asked if buying a flat as an investment was a good idea, I generally pushed back stating “If you’re buying it to live in it, then you may consider it but if you’re buying it to rent it out, think very carefully”.

Buying vs renting:

I too was not really in favour of buying a house with the simple thought process that -

I would rather pay a rent of 30k than pay an EMI that is 2-3 times that amount

I don’t want to become a slave to an EMI for the next 8-12 years

But that changed a lot in 2023. What had changed?

Rents went up astronomically in Bangalore. The place where I currently live is nice but not so much that the rent was hiked by 25% at one go. I was pissed off but didn’t want the hassle of looking for another flat and pay for the moving and set up cost. I have also heard of cases where people were asked to cough up a rent that was upwards of a 50% hike, such as this excerpt from The Ken

When you plan on an excel sheet, things seem to be a certain way that seems ideal, but when you get hit by a psychological whammy like having your rent hiked by 25% (or be asked to vacate at short notice), it does change your perspective a lot.

I realized that I will at least own an asset after paying those hefty EMIs and then become closer to financial independence later on unlike the case where I continue paying rents.

As much as you say you dont care about it, but being a home-owner comes with a sense of pride of home ownership that a rented house just couldn’t get. People who were tenants got slightly second class treatment in apartment societies and are not eligible for any kind of association involvement. A couple of simple examples of how people in my current apartment owners thought of this:

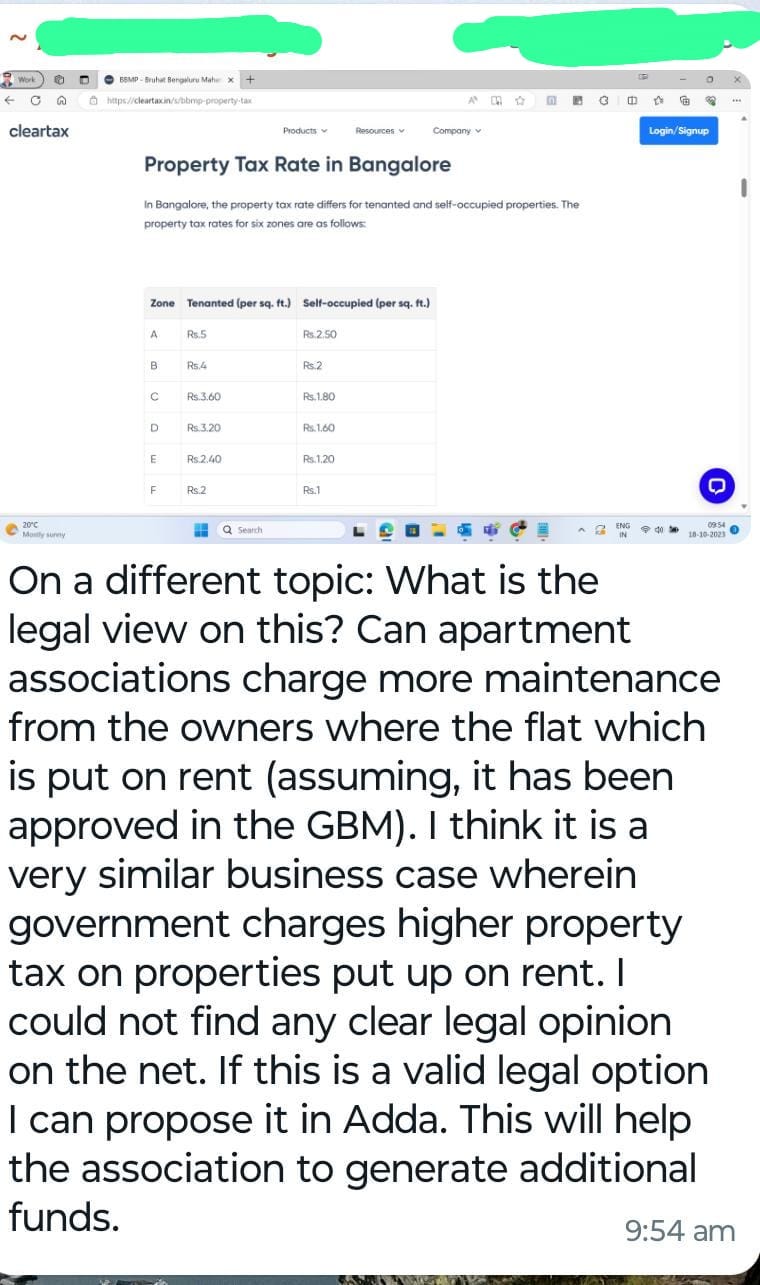

A person stored his tenant’s name as “Rent Hemant”. Genius apartment uncles who want tenants to pay a higher maintenance fee and have differentiated amenities.

While I knew that I would definitely find it difficult to have the flexibility to take bolder decisions like a sabbatical or take up entrepreneurship, the fact that I had some reasonable enough savings as a buffer and my wife who was also earning as much as me helped.

Finally, while doing the math on how much EMI I paid as a % of my income vs rent as a % of my income, the table below shows that paying rent would be favourable now but in the long run, paying an EMI would be better. And unlike in renting a house, you end up owning an asset with some value.

All of this led to my wife and I being convinced that buying a house is the next logical step. The boom in property prices in 2021-2023 also led to a sense of FOMO which adds to your psychological bias “I should have bought a house back then when it was 25% cheaper”. Unfortunately for us, we didn’t really know that the demand for flats arising from the post covid job boom will outstrip the supply (which was also paused in 2020-2021) to such an extent. Also, equally importantly, we were in a different financial position back then.

Even the government of India wants people to own houses and provides a waiver to some extent on your taxes, if you have a home loan to pay.

I know that some of you will say that this is not a black and white decision, of course its not -

The asset you own MAY depreciate in market value due to certain factors

It does make you financially a little inflexible in the near future

As mentioned in the start of the blog, property prices don’t go up forever, it can see time correction or even a price correction which means that it not necessary that you make a reasonable profit on your purchase if you decide to sell it 5-10 years later

If you end up buying a flat at the wrong area, society etc (say - you later find out that the area if prone to flooding or if some major construction activity takes place nearby) you can’t switch tracks and get another one so easily

You may not be as flexible to change cities or change your locality as per your new job in the near future

I obviously acknowledge that not everyone will be in a position to have enough income to purchase a flat, especially in large cities

Therefore, this decision really depends purely on YOU and your life. There is no magic formula and each of us will have different experiences, biases, priorities and capabilities and limitations that will play a factor in this. Morgan Housel puts it perfectly in his book The Psychology of Money:

This blog is called Bangalore Blog 4 for a reason - and that will show in the next half of this blog.

I will delve into the entire flat hunting process that my wife and I went through and all the factors that we prioritized while making our decisions which range from location, new vs resale, public infra/transport, facilities etc. I will also throw light on the unhinged real estate boom in Bangalore and how giant apartment complexes with utopian name such as “Dream Acres”, “Cornerstone Utopia”, “Blue Waters”, “Lavender Fields” etc are in the middle of such a dystopian setting where there is abysmal infrastructure and traffic, no public transport, no water connections and how its adversely affecting the lives of lakhs of people and brand Bangalore.

Stay tuned!