I was talking to a senior colleague of mine about treasury investments. He mentioned something about a bulk FD issued by an NBFC where was getting a 7.5 to 8% interest for a 6 month tenure at a time when no good bank offered more than 6.2% for their FDs for that given tenure. I joked to him that in case I had a few crores to invest, I would be happy to invest into that option.

A young team mate of mine overheard us and asked us “Why don’t you invest in 12% Club instead?!" Why only 7-8%”. Both me and my senior colleague were left speechless for a few seconds and then I mustered up the fortitude and asked her with as straight a face as possible “You do know that 12% Club is P2P lending which is extremely risky right? You might as well take that risk with equity itself”. I don’t think she was quite aware of the same. In fact, even the great serial entrepreneur demigod Ashneer Grover himself said that 12%club and Bharatpe was going to fail (coming from him, I take that with a pinch of salt of course). It appears that 12% Club is still going okay and for her sake, I do hope it stays afloat in the near future.

Similarly, both during my tenure as a “private banker” at Kotak Wealth Management and after that, I have made some poor investment decisions and seen a ton of people around me do the same as well.

What are some of these decisions?

Trading- both F&O trading and day trading are so easy to access now that everyone wants to take a shot at it. Ads by brokerages such as this one nudge you towards this with taglines such as “yeh market sabka hai”. Thankfully, Zerodha’s Nithin Kamath has some courage to spit unpleasant facts

Now, trading may seem sexy and a tempting way to make a quick buck but in my experience, trading is a net net losers game for most. Why?

The upside is limited because you are likely to exit after a certain gain (say 2% on an intra day trade) since you are not sure how much more you are likely to profit from that trade. But the downside is massive because you do not have the discipline to abide by stop losses (Say at -1% loss) and hope that the tide turns in your favour. Often, we may even average down (keep buying as your losses worsen) and eventually, you are left in deep red once the script spirals out of your control.

Trading requires extreme discipline both in terms of applying stop losses and knowing when to enter and when to not. Its best done if you are doing it full time, have picked up some skills and experience - most of us don’t fall in this bracket. We may enter a trade at 9 15 AM and then may be driving to work at 9 30 AM and get humiliated for your sales numbers at 10 AM. You dont have to take my word for this - see below

F&O is especially risky because of the exponential nature of its returns and damages. My guess is that not many who indulge in it understand the concept of in-money and out-of-money, let alone fancier terms like gama and theta

The issue with trading without discipline and rules is that once you enter, you then you enter more trades to make up for your losses and this can eventually spiral uncontrollably and burn your hands. This is how casinos make money my friends.

Equity investments: Direct stock investing is sexy - its a way in which you can show your alpha dog nature by using your “skills” to pick stocks that beat the market - everyone (including yours truly) thinks they are smarter than the market. Lets face it, SIPs are boring, index investing is even more boring. Why not try to appear smart in your social circles by claiming to have made 3x in Bajaj Finance or 18x in Kalasipalya Trucks Pvt Ltd.

Granted, some people actually beat the markets but many are humble enough to admit that they had luck as a heavy tailwind apart from their superior stock picking skills. In fact, in a developing equity market like India, its alright to have a part of your money a direct stock portfolio if you are able to manage it (more on that later)

The thing about stock picking is that almost all of us do it with extremely limited and narrow point of view and ignore other aspects that may suggest that its not a good investment. Some examples -

“Solar and wind energy is the future” so lets invest into Suzlon and Borosil Renewables and Adani Green. But what about their fundamentals? Do they have adequate cash flow? Are they dangerously leveraged? Are the valuations making sense? Is the promoter group trustworthy? This is probably too much nuance to seek for which we dont have time for

Entering stocks that are rallying like crazy due to FOMO (“I wish I had invested earlier when it was low)

Entering and churning stocks based on tips from people on Twitter, Telegram, CNBC etc

Getting influenced by influencers on stocks

This stock has fallen by 50%, it looks like a great investment opportunity now.” What has changed fundamentally my friend?

Success stories in stock picking is a classic example of survivorship bias - you see the successes but not the failures. You see the stocks that went up 2x but not those that ended up 70% down.

Lack of diversification: I admit to have scoffed at people who invested in real estate with gyan such as “you get only 3% rental yield, why would you invest”. Some people scoffed at people investing into boring FDs and debt mutual funds. But guess what? Residential real estate is going bonkers now and for folks who invested even 2 years ago, it looks like a stroke of genius to have invested then. FDs and other forms of fixed income give you that room the sleep peacefully in tough times and and are better suited if you want to buy a house/car etc in the near future.

Not investing in gold (SGBs to be precise) is one of my biggest regrets in investing.

Diversification matters!

Buying and selling excessively chasing 20%ish returns.

In the world of venture capital, there is something called the power law which states that most of your returns come from 20% of your portfolio companies and come in the form of 5-10x.

The stock market is a toned down version of the same, most of your returns will come from a handful of stocks that are in your portfolio for a long time. If you keep chasing 20% returns, you will lose out on the 100% and 200% returns and continue to suffer with the -40% return stocks at the same time.

Looking for exotic investment options: Where do I even begin? I even wrote a full piece about this in this blog

"Influencers" and investment that are too good to be true - my experience with such 2 exotic products

·This is a slightly longer version of the post that I had put on LinkedIn a coupleof weeks ago. Crypto platform Vauld recently suspended its withdrawals, trading and deposits. As the screenshots suggest, it was marketed as a ultra high return FD by some (in) famous influencers as seen below.

While I have mentioned only 3 types of instruments in the blog above, always remember that:

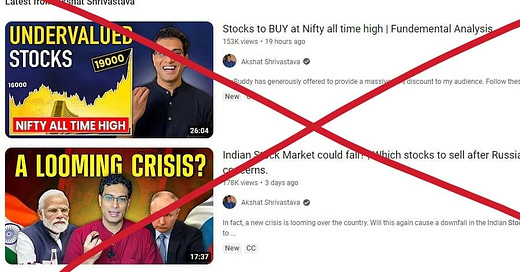

"Influencers" and stock market tipsters/gurus have zero accountability for their recommendations and are just trying to get the maximum visibility at that given moment. Look at this absolute buffoon and the irony - just 3 days apart!

If something seems to good too be true, especially around investments, it just might be

Most bankers, relationship managers, investment advistors and tipsters have own vested interest to make money out of you. This is coming from a former relationship manager and his own experience.

Some fundamental truths about investing

Investing is actually far more about our behaviour/temperament than our sexy stock picking skills. IMO, you’d be awesome if you abide a few of the following-

Save money not with a target but a way of living (ahem yours truly and his Marwari roots is an example) and invest for the long term. Don’t keep churning everytime you get a sense of FOMO.

Invest regularly, ideally in multiple asset classes but not in bullshit. Even index investing is awesome if you do it regularly

Have a little bit of conviction to invest just a little more when the world seems doomed and your portfolios are in deep red (much easier said than done I know). I feel that its far better to invest when the market as a whole is down THAN when a particular stock is down.

Respecting the fact that most sectors are cyclical in nature. I had written a piece on this as well.

Respect valuations. The markets can stay irrational longer than you can stay solvent. This is probably the HARDEST lessons I have learnt in investing and have lost a serious amount of money by not respecting it.

Not getting carried away with what people around you say. Remember - everyone wants to sound smart, everyone has a success story and successful picks, everyone around you seems to be making money but you don’t. This is a fallacy and don’t fall for it.

NOT following Akshat Srivastava. God I can’t stand him

Anyway, I hope you have absorbed enough wisdom from this blog to start tagging me on Twitter with the hashtag #IndiaKaMorganHousel

Loved the post! "The markets can stay irrational longer than you can stay solvent" -- agree that we've all learnt this harsh lesson when we've had some strong thesis about some "crazy undervalued stock". Also, saw the parallels with Morgan Housel in your writing, especially when you were mentioning FDs (since he talks about psychological safety that people can get by keeping a substantial portion of their assets in cash/cash equivalents/etc), and how it can be worth "more" than the lower financial returns. #IndiaKaMorganHousel hashtag suits you!

You are clearly jealous of Akshat Srivastava; he is a living legend!