SVB, Credit Suisse's downfall and the Indian goverment's war on your investment products - a lot that is happening in the world of financial markets

Credit Suisse and SVB

The big news in the last few weeks is the rapid fall from grance of high flying Silicon Valley Bank due to gross mismanagement of their own investment book which eventually led to a crazy and rapid bank run.

What happened at SVB? In a nutshell, here goes my attempt to explain -

Now if a fast growing large bank as SVB fails, it made everyone panic on how other smaller regional banks could be better off and withdrawals start there as well giving a casualty in the form of “First National Bank”.

This phenomenon spreads globally and bank stocks take a hammering. India is relatively better off in this sense (although we have seen bank failures here as well) but the bank stocks still get hammered.

Now the biggest systemtic risk in global banking has for years been in Europe specifically with 2 banks -Credit Suisse and Deutsche Bank. To get an idea- just look at their share prices between 2008 and 2022.

These banks sturggled to make money after the interest rates in Europe and US went to 0% - who could they lend to when money is available to cheaply outside? They then did a lot of stupid and risky things such as lend to risky borrowers such as shady hedge funds or to do some bat shit crazy trades on their own books which ended very badly. They also struggled to compete with US banks like JP Morgan and Goldman Sachs when it comes to investment banking and other fee based services. Their famed reputation for “wealth management” (also a safe haven for “black money”) was also struggling to make money.

Here is a good article on the timeline of the downfall of Credit Suissse.

In fact Credit Suisse raised money from the Saudi National Bank in 2021 to stay afloat which turns out to be the worst investment decision in recent history.

Now, the SVB led global panic led to Credit Suisse (which was already reeling with deposit withdrawals, issues with its financial reporting, a LOT of scrutiny over shady transactions and inability to raise further money to stay afloat) and finally UBS and the otherwise neutral Swiss government had to step in and rescue the bank after a lot of pressure from the US and UK - allowing CS to go bust would lead to a global contagian which could see a repeat of the Lehmann Brothers induced 2008 financial crisis.

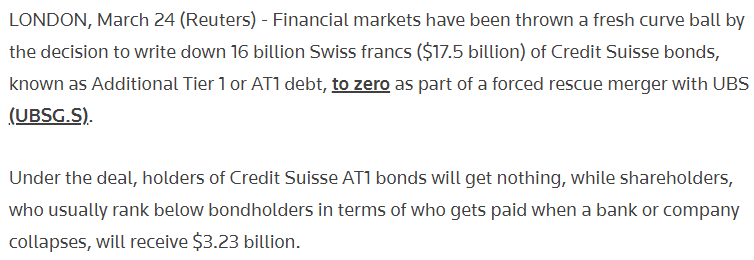

Furthermore, some bondholders who bought “AT1” or “Coco” bonds got another huge blow. Rememeber that in corporate finance -debt is always given preference over equity in terms of right? Well, not in this case.

The risk and shadiness of AT1 bonds is not new - we too saw the same taking place in India with YES BANK. That deserves another fresh post because I have some other anecdotes I’d like to mention alongside.

There is a buzz that Deutsche Bank, an even more important is now facing that extra heat.

How the Central Government (and SEBI) is waging a war on investment products

How do “wealth management” entities in India make money? They do so by selling you host of investment products such as mutual funds, PMSs, AIFs, ULIPs/Insurance etc and some cross selling of loans, bank accounts, brokerage etc. They have an arraangment with the fund manager to get a % of the funds they sell as a back end commission from the fund house itself - this can either be on an annual basis or “upfront” (all the commission for 4-5 years paid upfront).

SEBI didnt like the fact that wealth managers were earning so much “upfront” money -a receipe ripe for mis-selling wherein wealth managers get incentivized by selling these products in lure of the upfront commission. So they banned “upfront” commissions of any form in PMSs. This may now also extend to AIFs (more exotic products with a minimum investment value of 1 Cr) and rumours have it that may also extend to insurance products. This was a good move.

In the budget of FY23, the central goverment introduced 2 key changes:

They said that HNI investment products called MLDs or market linked debentures (think of it as a fancy fixed income product that is subject to some terms and conditions linked to the performance of equity markets) which were charged at 10% will now be taxed at the income slab (20%/30%) etc instead. Another good move.

They increased the TCS (tax collected at source) on your foreign remittances from 5% to 20%. TCS is not an additional tax and can be adjusted against your final tax liabilities. Nonetheless, you will have to pay an additional $20k for every $100k that you want to remit - which is definitely a problem. The government probably did this to track spending by HNIs and to take cues to reduce tax avoidance done rampantly by many. But this was overall a bad move which would hurt an average citizen.

The biggest bombshell was thrown yesterday and was regarding taxation done one debt mutual funds.

A quick primer on how debt mutual funds are taxed:

If you buy Rs 100 worth of debt mutual funds today, you will be taxed as per your tax bracket (Short term capital gains tax) IF you sell it within 3 years. However, if you hold it for more than 3 years, it will give you the benefit of “indexation” in the long term capital gains tax (LTCG)

Example - If you buy Rs 100 worth of debt mutual funds and its value is at 125 after 3 years and the inflation has gone up by 20% in these 3 years (Approx 6.5% per year). There will be a tax of 20% ONLY on the value of 125-120 = 5. So the total tax you pay is ONLY Rs 1. This is far better than an FD where you pay the full tax as per your tax bracket. This makes debt mutual funds extremely attractive as an investment options vs FDs, deposits, and other forms of fixed income.

What did the government do? They removed this indexation benefit completely for all gains made after 31st March 2023. So in the above example, you will have to pay a tax of 30%*25 (total profit) = Rs 7.5 (instead of Rs 1 only).

This was an extremely poor move in my opinion.

India has a nascent investment culture which was blooming over the last few years where people were thinking outside of FD and properties and investment in financial markets. India has an even more nascent debt market and mutual funds are KEY buyers of bonds that the government and corporates sell in order to meet their operations

Now the bond market will take a backward step in its much needed evolutions and boring old banks will have the upper hand - both in getting more deposits from investors and getting lesser competition from bonds as avenues of corporate borrowing

The government has been on path of removing as many tax arbitrage opportunties as possible. In a time when people want the 80C limit to be increased, the government wants you to opt for the new regime instead which has minimal tax savings tools. They also declared that insurance premium’s worth 5L will not be tax exempt anymore.

While the intentions are probably clear, I believe the government is only hurting not only the debt MF/bond markets in India but also make the salaried tax payer, who is already unhappy on the % tax she pays, even more unhappy.

1 step forward, but 2 steps backward.

Anyway that is a wrap up of a lot of things that is happening in the world of banking and financial markets in the last few weeks - you can proceed to put some money into SBI’s FD and enjoy a handsome return of 6.8% and then get taxed 30% on that.