Tips around Stock Tipsters, "Market Gurus" and "Must Buy" Stocks

This is a copy paste of an article I had written on LinkedIn last year but resonates a lot with me.

The good that the internet has done is that now everyone has a voice. The bad thing that the internet has done is that now everyone has a voice.

Lets face it, there is an explosion of content out there on literally everything across all channels, spearheaded by YouTube, WhatsApp and Instagram. Its become too easy and everyone manufactures content and the line between quality original work and content for the sake of content (including copy pasting) has blurred significantly.

There was a decent piece in the Ken where they pointed out how even traditional print media struggled to adapt to the needs of the online world and their staff was just forced to manufacture content for the sake of content - https://the-ken.com/story/why-indias-legacy-media-is-still-far-from-being-in-nyts-league/ and if you have a lot of spare time, this piece is a deep rant on the explosion of content from an anonymous writer who I follow on Twitter - https://nakedbeta.com/musings-rants/everything-is-content-and-everything-is-shit/

All of this is perfectly applicable to the world of investments as well. Do you remember getting those random calls from those stock "research" companies in Indore who promise multibagger tips? It seems that they have shifted careers and become full time social media influencers

You may not be clear and want me to elaborate on this point? I'm posting a few self explanatory screenshots taken across various media to give you an idea -

"Cheap stocks" are those that are under Rs 100 akin to vegetables and a bar of soap (what is all this valuation nonsense?)

Put Rakesh Jhunjhunwaala or Warren Buffet against anything like "Rakesh Jhunjhunwala Penny Stocks 2021"

"Fundamentally good" penny stocks (cries at the irony)

A young confident dude asking us to blindly trust 8 stocks (to the grave)

Tipsters and self proclaimed humblebrag gurus post screenshot of their successful tips and also benevolently give seminars to spread their secrets!

Even on TV, you see "experts" on CNBC, ET Now, Zee News etc all giving out stock tips and hot themes as if there is no tomorrow.

So lets get to the point - What is the catch? To this the answer is simple, ask your self and think deeply "What's in it for them?"

Why would a so called market expert give out so many opinions for free? Why would a TV channel want to keep giving new hot tips each day? Why would a market guru give out big and bold statements etc. I'll provide my own interpretation for each such stakeholder below:

A tipster:

Imagine a tipster giving out advice to a 1000 people - 2 stocks to 500 people each. Now lets assume a 50-50 probability of this tip succeeding. The 500 drop out but the other 500 remain. Now in this 500, he recommends another 2 stocks to 250 each. This repeats again for a third time till 125 get the third one also correct. Now to those 125, he is God and the tipster uses these as proof of his stock picking ability. Wow!

A front runner: Another version are those magnanimous gurus who give out tips (not necessarily as random as above) with some sense of logic. Now why do they have to give it out anyway? Simple - imagine a stock guru with 50,000 subscribers in telegram. He says, hey, this small/mid cap stock looks good (with xyz reason which is somewhat legitimate).Now in those 50,000, at least 10000 see his message and 1000 actually act on it instantaneously (a few of whom might even be an algo reading twitter/telegram feeds). Now the stock runs up instantaneously, more people buy it and it runs up even more later - basically a virtuous cycle. The stock guru had a position in the stock before and benefits the most monetarily and also "look, its 20% up in 3 days. I told you so!" and gets even more subscribers to join this bandwagon (until SEBI wakes up sand says, okay we need to do something). What the best part in this - the stock guru ONLY has an upside. If things go wrong, he just stays quiet or just says "consult your financial advisor before acting on my recommendations". HAHA!

Pump and Dump: This is RAMPANT in penny stocks - those that trade at very low value and volumes. Imagine a shady professional HNI investor approaches a shady market operator and says hey, please help me promote this shady penny stock in the market, I'll give you 25% of the profits. So the shady operator uses his army of tipsters, SMS/moneycontrol forum spam etc and gets innocent retail investors onboard. The stock is at upper circuit virtually everyday for weeks (And hence these retail investors cannot exit in time so easily and are anyway hooked by the greed of a greater upside). More and more retail investors are hooked and one fine day, the shady HNI investor sells a large chunk of his stake and the stock is on lower circuit for weeks with poor retail investors stuck and those that entered at the peak lose out massively. This my friends, is called Pump and Dump.

2. Gurus who appear on TV/other media:

In one word - marketing. Promote their funds, promote their personal brand and remain afresh in the minds of the investor base.

A few of them make outlandish and outrageous statements - an example of which I've shown below:

Why do they make such seemingly illogical and outrageous claims? Because in the outlier event that this DOES happen (and if you take a longer time horizon, the probability of this coming true increases from absurd to unlikely), they will leave no stones unturned to tell everyone "I told you so" and use media coverage to create a cult around themselves.

3. TV Channels like CNBC/Zee Business themselves:

In 2 words - Grab eyeballs. Have you noticed how the anchors are almost machine like in their routine to milk stock tips, hot themes etc from the market gurus? Fresh ideas are churned out like a Toyota production line to keep stock tip hungry retail investors hooked. Maybe CNBC will apply for a six sigma soon.

Now normally these anchors are barred from buying equity themselves and can only buy mutual funds. However, its well known (and many have been caught) that many of these use their influence on TV to promote stocks which they purchase in their relatives' demat accounts (again front running!)

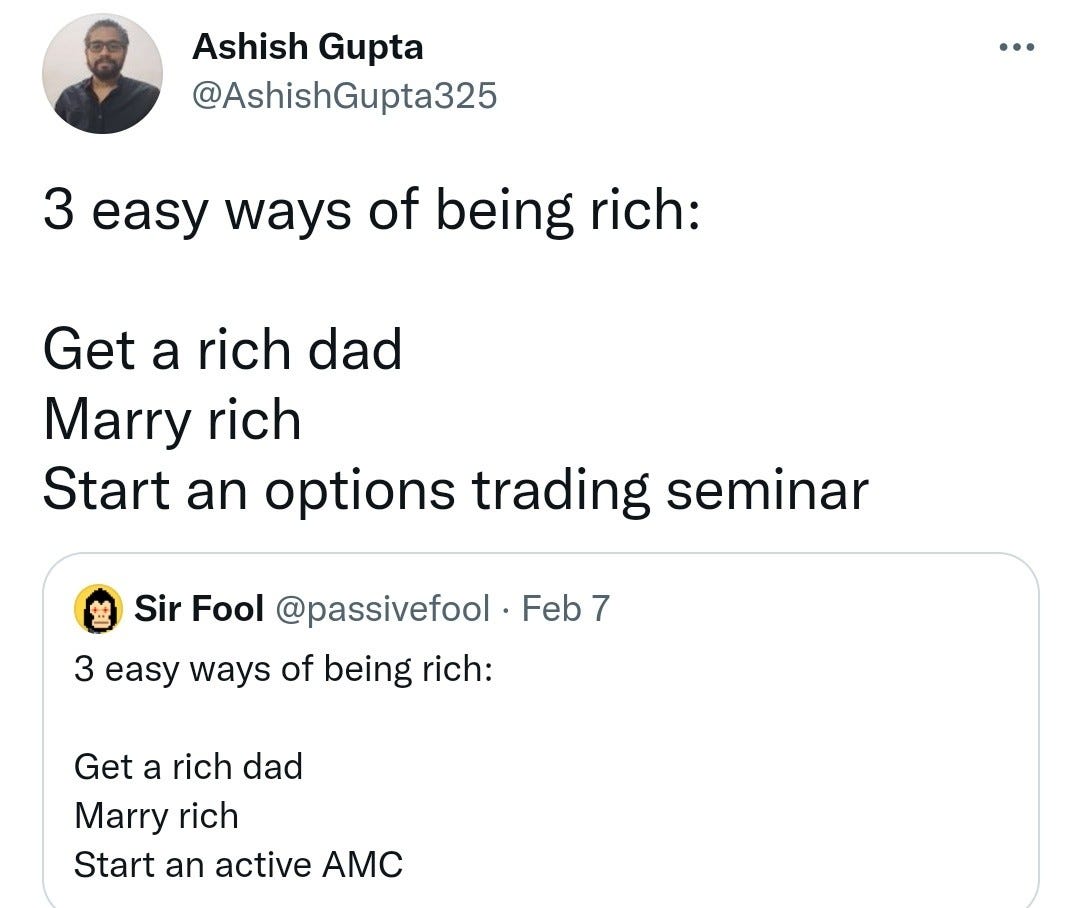

4. Folks who paste options trading screenshots with crazy profits:

Simple - to make you their sheep and to milk some kind of return from YOU be it via "options trading seminars" or promote something else. Its well known that not many people ACTUALLY make profits in full time trading and even if they do, they wont waste time and energy trying to promote their riches on social media

5. Finally, social media channels and gurus (refer to the screenshots from earlier)

Again, just like TV channels to grab attention and views. The only difference is that TV channels do it behind a garb of regulation and a semblance of a formal setup but the animal is completely let loose on social media. The more the views these influencers have, the bigger their channel and reach is, the more ad revenue they get and the more "partnerships" they can maintain with companies, brokers and who knows what else. There is an OCEAN out there on Youtube, Instagram etc on gyan and tips around stock markets and investing - I still get amazed by it.

Why do people fall for these? Temptation of quick money and the trait to inherently lean on public figures to guide them because they are afraid of failures due to their own decisions.

The Indian equity markets are on a relentless bull market, millions of new investors have come into the market - everyone be it investors and gurus are at high - until the market crash. This has happens in many many cycles earlier and history will only repeat itself.

I guess I have given you enough of an idea of what I'm trying to convey. To be fair, you do expand your knowledge by hearing out interviews given by market gurus and getting some idea of which stocks are on a tear and why they are on a tear. But that doesnt mean that you actually go buy all of these hot themes and stocks yourself - maybe think of this as knowledge accumulation which may help you spot opportunities in the future?

So when it comes to taking tips from stock tipsters, tv channels and market gurus- don't stay hungry, don't stay foolish and ask yourself -"What's in it for them?"