Why investing in IPOs is generally a bad idea - an analysis of IPOs in India in 2021

It’s a glorious day outside - full of sunshine and the temperature is mild enough to go out for a nice long walk. I am however, unfortunately, having a need to prove to myself the validity an oft said adage “Investing in IPOs is generally a bad idea”. To be fair to the weather, I did go out earlier in the morning.

So you will hear of many cases of people of people who got lucky in an IPO allotment or even bought shares on allotment and held it for 5/10/20 years and made a lot of money. The classic example you will hear from the older generation is that of Infosys and from the younger generation is that of Avenue Supermarkets aka Dmart. If you dig into the history of VCs and Silicon Valley, you will also hear of how a lot of people (VCs/individuals alike) made a lot of money by buying and holding onto the likes of Google and Amazon from the early stages after it had listed in the public markets. You always apply for all IPOs are feel some FOMO if you dont -especially if everyone around you is.

All of this is referred to as survivorship bias - we see only the success stories and get enamoured by it and overlook the failures that have not survived to showcase itself.

Before I get into some datapoints, here is a very very basic primer on IPOs. I strongly suggest looking up on YouTube or reading articles to understand more - I don’t want to repeat something that is easily available online.

Why do companies go for an IPO?

Promoters who have grown the business get to exit a part of it and encash it while still running the overall business

The company needs to raise capital to help fund growth (organic/inorganic) or to reduce its debt levels

The company is backed by PE/VC investors who can’t stay on as an investor forever and need to exit its investment in the company so that it can return the money and profits to their own limited partners (LPs are investors into the PE/VC fund)

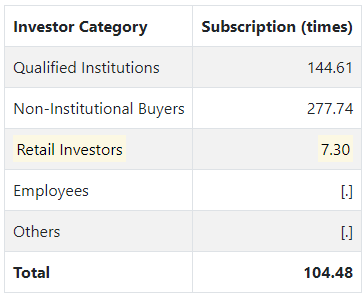

How does IPOs allotment work? (please excuse me if this is a little outdated). I’ll take an example of the Avenue Supermarket IPO aka Dmart. This is the final subscription of the IPO which took place in 2017.

Before an IPO is available for you to subscribe, it first needs anchor investors (big institutions/family offices etc) who provide some price discovery to the IPO

The IPO is then open to the public via 3 routes - QIB, HNI and Retailer. There is also sometimes some quota for employees of the company going for listing (especially PSU companies)

QIBs/Qualified Institutions are meant for institutions and are hence almost irrelevant to you. For Non-Institutional buyers aka HNIs, the system works in such a way that if the final subscription for the HNI portion of the IPO is 277x (as seen above), everyone who applied gets (1/277) = 0.36% of the amount they applied for (imagine applying for 1 Cr and getting only 36 thousand!). There is a lot of lending done for HNI portion of an IPO by NBFCs (which saw a clampdown by SEBI recently) which led to astronomical subscriptions in the many IPOs by HNIs (This is a field in itself with things like Grey market premium etc which is a long field in itself)

For Retail investors, the system is equivalent to a socialist system - the allotment is such that the maximum number of people get a lot each. One can get 2 lots ONLY if everyone has gotten a lot. This is rare unless the retail portion of the IPO is undersubscribed/flopped.

This is why you see many people applying for IPOs via multiple demat accounts with different PAN numbers.

The chances of you getting an allotment from your PAN in this IPO would be somewhere between 13.6-20% IMO (impossible to ascertain the exact number)

So I’ll dive into the data now. I got the data from an IPO focussed website called Chittorgarh.

Do note that a few of these numbers MAY be erroneous due to this website not factoring in an adjustment for bonus shares (I spotted and corrected a couple myself)

I choose 2021 because it was a “hot” year for the markets and IPOs in general - especially given the abundance of easy money in the global markets after the covid triggered stimulus from various central banks across the world.

Current price is as of 4th February 2023.

The chart above shows the following prices 1. The issue price 2. The closing price of the stock on the day of listing 3. The current price of the stock

Some observations:

We know that getting an allotment for a retail investor in popular/hot IPOs has a low probability (as seen in the Dmart example above). So the chance you’ll get a allotment is low. Even if you do, you’ll most likely get only 1 lot worth around 15000 rupees. Unless the IPO goes 50-100% up on the listing day, its hardly a noteworthy gain (well at least for me)

Note that in this list of 65 IPOS, if you got allotment in all of them and held them till date, you would lose money in 30 of these stocks. That means almost half the IPOs lead to a loss if you get the allotment

IF you buy the stock (say Rs 1 lakh worth of it) on the day of listing at 3 29 PM (just before closing), you would have made money more than FD only in 18/65 stocks. Just 18!

You would lose more than 20% of the invested value in 29 of these stocks if you bought it on 3 29 PM on listing day

Please assume a small room for error in this analysis. However, I hope you got the spirit of what I am saying - IPOs make for overrated avenues of investment - be it before listing or after listing.

Why do IPO-ed stocks fare poorly?

More often than not the main reason is because a lot of stocks are listed at a very high valuation. Existing investors, especially VCs/PEs want to exit at the maximum possible valuation (partially or fully) and leave very little room on the table for long term upside. I think this point is especially accentuated in modern times thanks to the abundance of “growth VCs” like Softbank, Tiger Global and by PEs such as General Atlantic, Blackstone etc who delay the listing and get the maximum value during exit leaving little behind for retail investors. This line from the Ken which quotes a fund manager named Shankar Sharma hits the nail on the head.

Most IPOs happen in a bull market (or a peak bull market like 2021). Think of this as buying a house when the prices have doubled in 2-3 years

IPOs are unfair to retail investors - most get lulled by the hype and FOMO created - the biggest even example of this (perhaps in Indian stock market history is that of the infamous Reliance Power IPO which tanked by some 40% on listing). Many HNIs/Institution get in on the action as private investors and get the upside most of the times

IPOs have information asymmetry and generally run on euphoria. Remember that fat DHRP which comes with a warning which says please read the offer document carefully before investing. How many investors do that?

Of course not all IPOs are bad. One of the thumb rules is that IPOs which are “fresh issues” are generally better than those which are on “offer for sales”. The former is usually meant for the company to enable growth or pare debt whereas the latter is more of an exit route for existing investors or the promoter (again, who would want to exit partially/fully at the maximum valuation).

I would be particularly careful about IPOs in bull markets done by loss making companies or companies that have suddenly turned profitable - the next such likely IPO is that of Honasa Consumer or Mamaearth - a great company/brand but likely a bad investment on IPO/listing day.

I think I can now go out on the sunshine for a nice long afternoon walk.