I got back from work a few days ago and got a call from my mother. She informed me about a shocking piece of news about someone in the extended family, who was barely older than I am, committed suicide leaving behind his wife with 2 very young kids. I remember speaking with him on the phone when I visited his house a couple of years ago and found him to be overtly warm and he was deeply apologetic about not getting to meet me in person. He was in a sales role and his affable nature clearly showed that he was a good salesperson.

So I was obviously surprised how such a man could commit such an extreme act and could only think of 2 things - deep depression or deep financial distress - with a tilt towards the latter. A few days later, it was confirmed that he did this due to some major financial entanglement he found himself in and I hazard to guess that is has something to do with the equity markets. I didn’t dare prod further given the sensitive nature of the same.

This isn’t even the first incident of stock market related financial distress in that side of my family - another person, from a small town who ran a small shop, got into losses well over my annual income and they had to sell a lot of their old assets to get him out of it and he is still in deep debt.

While I was really sad for the suffering of the wife and the 2 children who I had met just 2 years ago and know since childhood, it also made me angry about how financial recklessness has led to such extreme misfortune and devastated the lives of people.

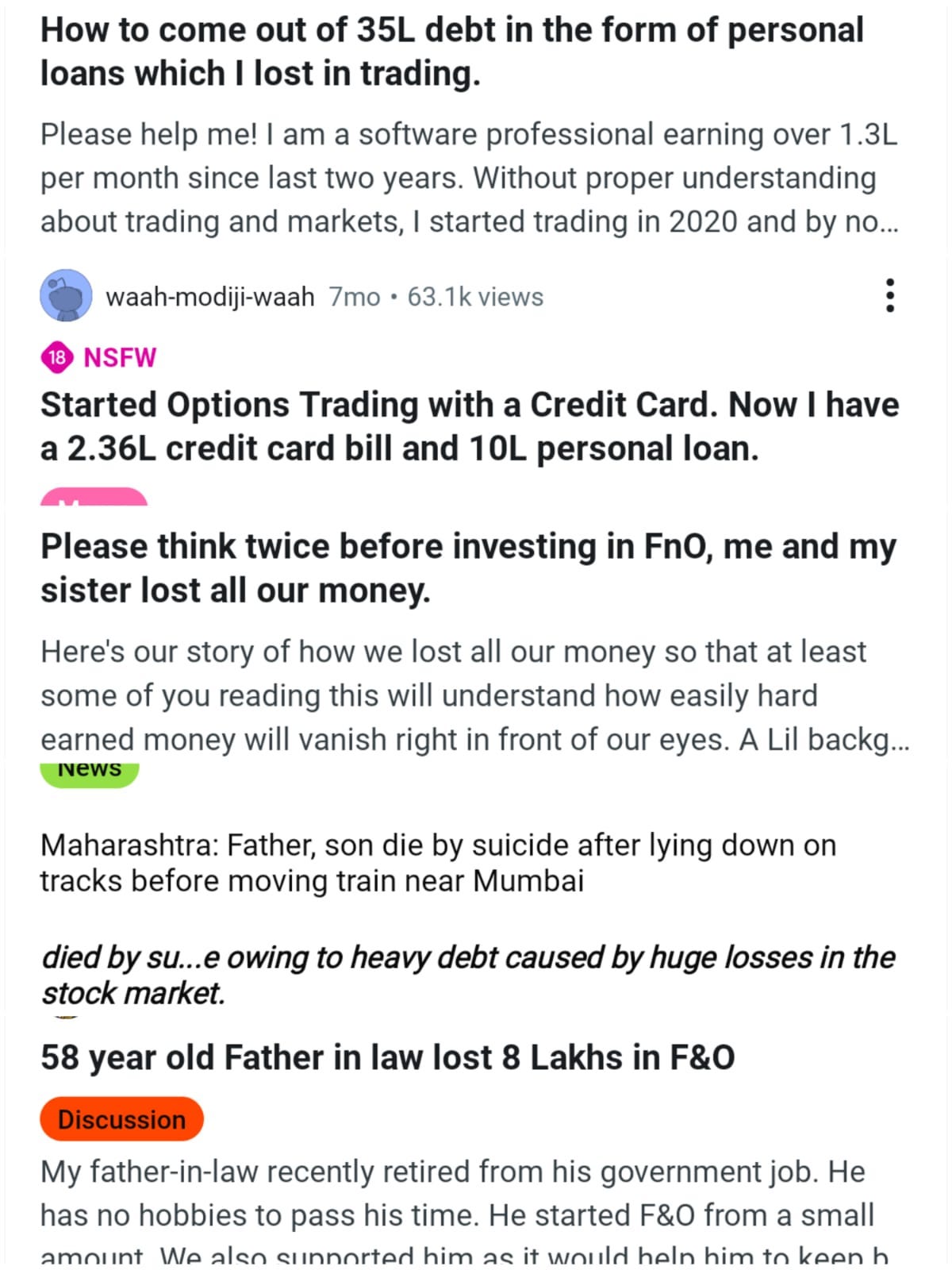

This is extremely common now - here are some snippets of people anonymously or publicly admitting to their misfortune. Remember - very few people have the courage to open up about their failures, especially financial failures, so these confessions are like a snowflake on the tip of the iceberg. Confessing your failures makes you feel extremely vulnerable mentally and people would rather be in denial than admit to it.

India’s stock market boom:

The ease of access to investing/trading, better awareness (“mutual funds sahi hai”) and the bull market has led to a crazy FOMO led boom in the equity market activity in India.

The chart below shows how deposits have fallen as a % over the years and the increasing amount of allocation to the equity market.

SIPs inflows are booming to 21k Cr per month (I remember that it was around 4K Cr per month back in my early days at Kotak in 2016-17) and even leading to a somewhat false narrative that India does not need to depend on FPI investments anymore given the sheer size of the inflows from the SIPs.

The craziest chart of all is the one below which clearly hints at the exuberance in the trading segment in India -we trade far far more than we invest as compared to any other country and the gap isn’t even remotely close.

So why have I limited my chatter about the stock market off late?

If you have been following me either via this blog or the articles I used to post on LinkedIn a few years ago, you would have noticed that I posted primarily about the financial markets. I was afresh from my days at Kotak Wealth Management and had enough ammunition to throw some perspective on the markets. A lot of people wanted to talk stocks and markets with me and whenever anyone around me talked stocks, I could not resist giving my opinion on them and “show off” my knowledge.

However, the stock market chatter has becoming draining in the last 1-2 years - too many people talk about it, everyone around seems to be checking out their pages (portfolio or positions) on Zerodha, Groww and other apps. About 2-3 years ago, I would have been pompous and scoffed at them and told them that the real test comes when the equity market isn’t booming but faltering.

But now, I simply avoid getting myself into talking about the equity markets and "gyaanbazi” especially when people show of their stock picking skills.

Am I being sour grapes? I humbly believe that is not quite so - while I’d like to keep the list private, I have my fair share of “multibagger” stocks in my portfolio like Zomato or Polycab or Dixon Technologies and also a few laggards like Indiabulls Real Estate or Laurus Labs.

Everyone wants to feel good about their choices and their new found knowledge and wants to talk about it - just like how school kids want to tell everyone around about this cool new thing they discovered - this is the exuberance of the “young”.

I just find it exhausting to talk about stocks and stock picking because everyone is opinionated (so am I) and basic conventional psychology suggests that people don’t like their opinions to be negated or belittled. So why would I want to be at odds with someone over such a trifle?

If someone wants to genuinely have an open ended debate on something specific, I’d welcome the intellectual stimulation and be happy to change my stance on something but if it get’s personal or excessively defensive, I’d rather steer clear and save that energy.

As I have written in a blog a year ago, investing is supposed to simple and fundamental - save regularly, invest regularly, don’t get too greedy or get excess FOMO, respect valuations and be wary of anything that appears to good to be true. At the core, anything beyond that is largely cattle fodder.

Investing is supposed to be simple and fundamental. So why do we complicate it so much?

I have also written why you should not take “finfluencers” and market gurus too seriously in this blog below.

The dark side of the equity market boom

You open Youtube, Instagram, Twitter etc and you see people showing of either their crazy portfolios or screenshot of some massive profits generated from a trade. You see people giving gyan on how to become successful traders and retire early and you even see people trading in the most unexpected of places as seen below.

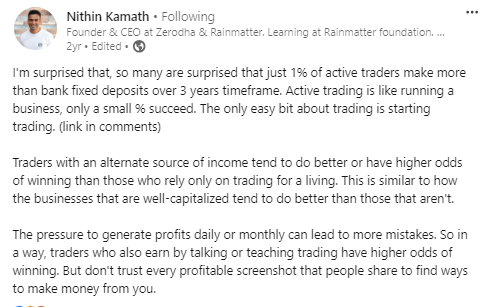

The reality is that making money consistently from trading is really difficult and it can also be extremely stressful. As per Nithin Kamath of Zerodha, less than 1% of active traders make more money than an FD.

Many people get entrapped by the world of trading after getting started because just like a sugar or cigarette addiction, trading is also about immediate dopamine release and even adrenalin. I know a friend of mine who is extremely bored at his workplace for years and has been indulged in trading for over 7 years but has not made any real money - he simply can’t get rid of the “thrill” of trading every day.

Psychology behind the entrapment in the web of trading

Excess connectivity with the world breeds a desire to grow rich fast and nudges you to also try your hands at this. You don’t see your job bringing you wealth and might even hate it and see this as your escape

You then get some small wins and then get deeper into it with bigger bet sizes

One fine day, you get into a negative position and don’t want to exit because of loss aversion and hope that it will come around - you might even average down

However, the loss gets bigger and bigger and you mental faculty spirals out of control and you are now desperate

You then re-enter another trade with revenge mode and want to make up for the previous loss as soon as possible but then you get caught in another trap and keep losing money

You feel ashamed and small and then borrow money in order to make up for the excesses but you can’t quite break even

You are now in deep financial distress but still keep seeing videos and photos of people winning trades and making money and you also get perturbed by people who are simply well off

This is on of the ways how one gets entangled into deep financial distress and they might even take the extreme steps as I suggested in the beginning of this blog.

I know about that because, while I have never indulged in F&O trading, I have learnt the hard way via day trading - 7 good days can be easily swallowed by 1 bad day.

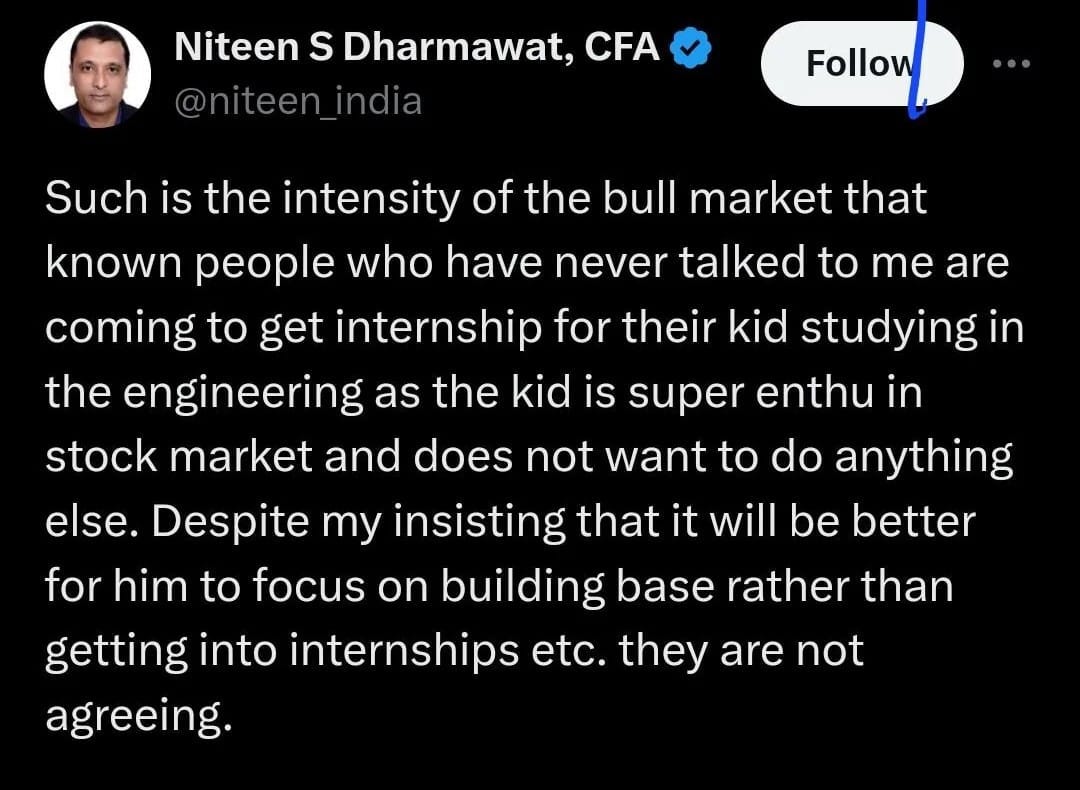

I have come across so many stories of students who are just not interested in studying or building a career but are caught into the dopamine web of trading. They want easy money and are heavily influenced by not just social media and “finfluencers” but their own peer groups as well. We absolutely cannot allow large chunks of the youth spoil the critical years of career building and get swallowed by this trading whale.

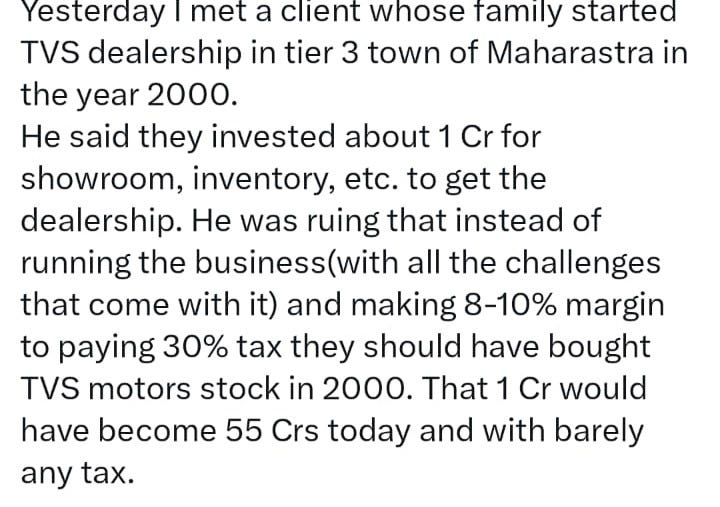

I have come across business owners who have reduced investing into their own business growth and believe that they can generate better returns from the stock market

Even the start-up world is suffering from the equity market boom - big late stage players like Alpha Wave Global have halted investments in India and believe they are better off identifying opportunities in traditional businesses - publicly listed or private.

I know that all is not all doom and gloom - I admire the success of the SIP revolution in India and the increasing awareness about long term investing amongst people who have traditionally put all their money into bank FDs or real estate. India is still heavily underpenetrated in terms of % of people who have invested into mutual funds and we are still very much a land and real estate loving nation.

However, the dark side of the equity markets is something that people should be equally aware about - there is no such thing as free lunch after all, right? If trading really was so easy, you’d find far more rich people in India.

If you are having a tough time with trading or know someone who is going through it, know that

It’s okay to not be able to make the quick buck when the world around you has seemingly cracked the code (they haven’t).

It’s okay to accept your losses and move on - you will not feel so aggrieved after some time passes.

Ultimately, it’s your focus on building real skills and that matter in the longer run and hey - you can still make handsome wealth by basic long term investing right?

Hey Pratik!

Very well written and researched article. I liked how you balanced your views with what industry leaders are talking about.

On the topic: yeah it really is crazy how many people are going absolutely overboard with F&O trading. Given what we know about the 1% traders making a profit, 99% of these people must be absolutely delusional when they talk about the killing they are making.

I'm gonna share your article with a few young (and quite a few old) folk who really need to see this.